I started reading about Luna after the crash and the more I read, the more I failed to understand. So many articles were mentioning DeFi and articles explaining how Luna works covered the exact same point about the seesaw. If demand for UST increases, Luna is burned and vice versa, thus keeping everything at equillibrium. It was as if the same explanation was just copy pasted on multiple websites and no one really understood how it works at its core. It was only a week after the crash that actual economic analyses started coming out. Suprisingly, these analyses compared Luna to traditional economies, there is no DeFi, nothing new and fancy, Luna works like every other traditional currency and are bound by the same economic rules.

| Luna | Traditional Currency |

|---|---|

| The value of 1 UST is pegged to 1 USD | The value of 1 SGD is pegged to 1 Brunei Dollar |

| Luna Foundation Guard sold more than 33,000 bitcoin from its reserves to defend the UST dollar peg | MAS has reserves to buy and sell the Brunei Dollar to maintain the peg |

| You can trade Luna for UST and trade UST for USD freely | You can trade SGD for Brunei Dollar freely |

| You can stake Luna to get up to 8% returns per year | US Federal Reserve interest rate is 1.75% per year |

As you can see, Luna is not much different from traditional currencies. Instead of a central bank, you have the Luna Foundation Guard setting monetary policy and exchange rate policy. You may also have noticed that there is no Singapore example for interest rate. This is because exchange rate policy is Singapore’s only form of monetary policy. So, why can't Singapore dictate an interest rate?

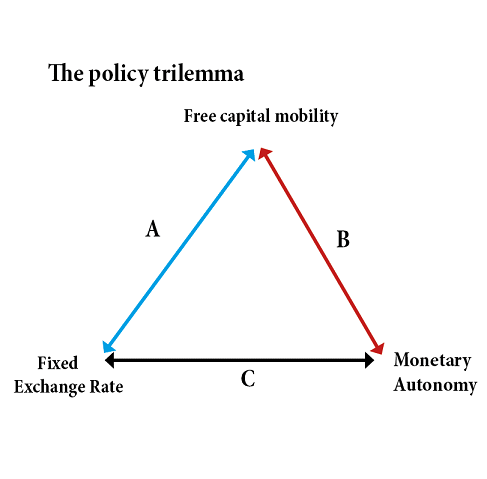

This is because of the Mundell Fleming Trilemma. A government has to choose 2 out of 3 factors. Singapore has chosen to control exchange rate and allow free capital movement, hence they have to allow interest rates to change according to external pressure. This Trilemma was presented in 1960s and over the years, there have been examples of governments (USD/MXN in 1994 and USD/THB in 1997) who tried to control all 3 and caused their currency to be depegged. I am not an economist and won't attempt to explain this any further.

It appears that beneath all the buzz and hype of DeFi, algorithmic stablecoins, and other seesaw mumbo jumbo, Luna is nothing new. It works the same as any traditional currency and has to abide by the same theories and constraints faced by them. They made the same mistake that Mexico and Thailand made in the 90s and caused Luna to implode. If you don't have a background in macroeconomics and cannot evaluate the economic model of a cryptocurrency, then trade at your own risk.